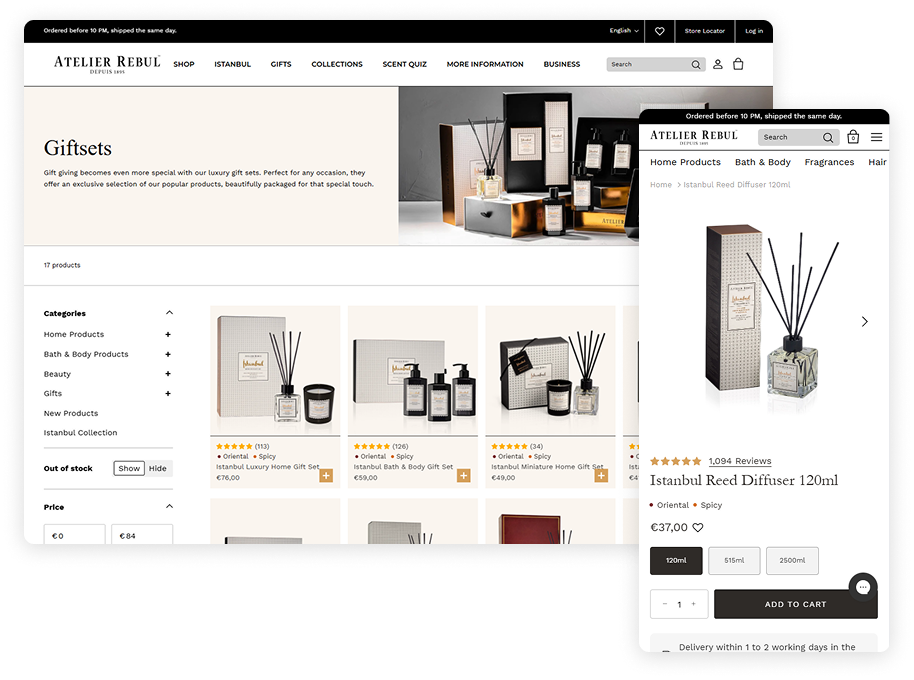

Atelier Rebul B2B Shopify Plus Case Study

Atelier Rebul is a premium fragrance and skincare brand with a strong presence across Europe. With a growing B2B customer base, the company needed an efficient way to handle VAT exemptions for business customers purchasing from different countries.

Our contribution

- B2B support

- Shopify Plus Checkout Extension

- Shopify Function

- Strategic Guidance

- Cross-border eCommerce

Tech stack

Manual B2B VAT Exemption Bottlenecks

Handling VAT exemptions manually was time-consuming and inefficient. Previously, B2B customers had to: Pay the full price upfront. Contact customer support to request VAT exemption. Share their VAT number for validation. Receive a manually adjusted invoice. This process created friction for business customers and added extra workload for the support team. The brand needed a way to automate VAT exemption within Shopify’s checkout, ensuring a seamless experience for B2B buyers.

Real-Time VAT Validation System

To streamline the VAT exemption process, we implemented a custom Shopify Functions-based VAT validation and exemption system, eliminating the manual back-and-forth. Here’s how it works:

1. Automated VAT Validation at Checkout

We integrated a real-time VAT validation API that allows customers to enter their VAT number at checkout.

The system automatically checks the validity of the VAT number before applying any exemption.

Customers immediately see whether they qualify for VAT exemption or not.

2. Country-Specific VAT Exemptions

VAT rates differ across Europe (e.g., 21% in the Netherlands, 23% in Portugal, etc.).

Instead of dynamically changing product prices based on location, we applied VAT exemptions as a discount at checkout, keeping pricing uniform across countries.

This ensures consistency in product pricing while still complying with tax regulations.

3. B2B Self-Serve Experience

Customers no longer need to contact support for VAT refunds.

They simply enter their VAT number, get validated, and proceed with a tax-free purchase instantly.

If a business is not VAT-liable (e.g., some Belgian businesses), they have an option to tick a checkbox to proceed without exemption but still receive a VAT-compliant invoice.

4. Accurate Invoicing & Compliance

VAT-exempt orders generate automated invoices reflecting the correct tax treatment.

If a customer qualifies for VAT exemption, the invoice clearly states “VAT Reverse Charge”.

If a customer is not VAT-liable, VAT is applied and displayed on the invoice correctly.

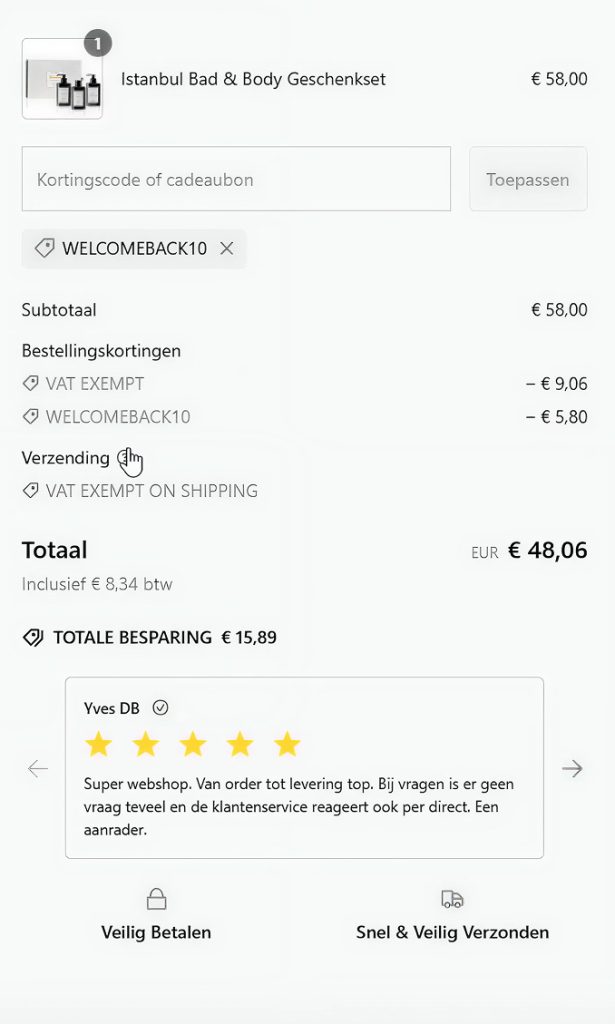

5. Smart VAT discount logic with Shopify Functions

We implemented a custom Shopify Function that correctly applies the VAT exemption even when discount codes are used — a common edge case that’s often miscalculated in standard setups.

The logic ensures VAT is applied after discounts are factored in, so the final invoice and tax treatment are fully compliant.

To ship this quickly and without overcomplicating the setup, we used Supaeasy to handle the deployment of the custom function efficiently, but also making it easy to manage if new adjustments are needed.

Results & Impact

✓ Faster B2B Purchases – Businesses can complete VAT-exempt purchases instantly without manual intervention.

✓ Reduced Support Workload – Customer support no longer needs to process manual VAT refunds and issue corrected invoices.

✓ Increased B2B Conversion Rates – Removing friction from the buying process leads to more completed purchases.

✓ Tax Compliance Across EU Markets – The system dynamically applies VAT exemptions based on European tax regulations.

“It’s definitely helping efficiency, so a big win in this regard”, CEO at Atelier Rebul

By implementing an automated VAT exemption system, Atelier Rebul significantly improved their B2B purchasing experience while reducing administrative overhead. If you’re looking for a way to streamline VAT exemptions in your Shopify store, get in touch with us today!

FAQs

Their B2B customers experienced delays and friction buying across EU markets due to a manual VAT exemption process.

A real‑time VAT validation API was integrated into the checkout using Shopify Functions to automatically apply exemptions and speed up purchases.

Yes—even though product prices remained consistent across regions, country-specific VAT was handled via a discount logic at checkout.

Yes—businesses can now enter and validate VAT numbers at checkout without involving customer support, enabling immediate exemption if eligible.

Invoices automatically state “VAT Reverse Charge” for exempt orders. For non‑liable businesses, VAT is applied and shown correctly.

Faster purchases, reduced support workload, higher B2B conversion rates, and full tax compliance across EU countries.

Check out some more showcases

Feel inspired by our clients

Impossibrew

Pulse4all